What is a CLO? (Collateralized Loan Obligations)

Explaining collaterized loan obligations in a easy to understand example

In the stock market, several Closed-End Funds (CEFs) specialize in Collateralized Loan Obligations (CLOs), offering enticingly high yields, often exceeding 10%. For investors drawn to these attractive returns, a clear understanding of how CLOs operate is essential. It's not just about seizing the opportunity for high yield, but also being well-informed about the associated risks.

What are Collateralized Loan Obligations?

Imagine I own an ice cream shop and want to buy a second ice cream machine, but I don't have the cash for it. You, as my local bank, check my finances, find them satisfactory, and grant me a loan to buy the machine.

However, there's always a risk that I might not be able to repay the loan.

You gave loans to hundreds of businesses like mine. If multiple businesses fail to repay, it would be a financial risk and negatively affect your balance sheet.

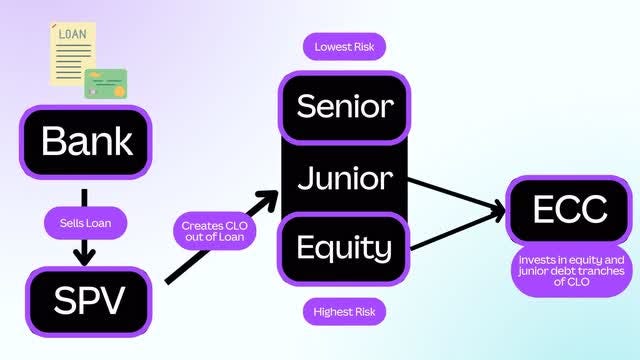

The solution: Instead of keeping these loans, you sell them to a Special Purpose Vehicle (SPV). The SPV is distinct and legally separate from you, the bank. It bundles these loans into a CLO (Collateralized Loan Obligation). Investors can then buy tranches, or pieces, of the CLO. The returns on these tranches vary based on their risk level.

The Risks for Investments in CLOs

While bundling loans can lead to diversification, there are still associated risks. A relevant example is illustrated in the movie 'The Big Short,' where Ryan Gosling explains the risks of CDOs, which are similar to CLOs but backed by mortgages instead of loans. This can be a helpful reference.

Complexity: The 2008 financial crisis demonstrated how bundling can lead to a lack of transparency. Investors often underestimated the risk associated with lower-quality loans.

Misratings: Tranches of a CLO are rated by credit agencies. However, these ratings rely on available information. Business owners might present an overly favorable view of their financials, leading to loans that appear less risky than they actually are.

Using Leverage: Many Funds who hold CLOs are employing leverage in their investment strategy. While this can increase potential returns, it also raises the risk profile, especially during market downturns. This leverage can introduce dangerous volatility.

Benefits of CLOs

Investing in CLOs, like the ones managed by certain Closed-End Funds (CEFs), can offer attractive benefits, particularly for those eyeing the high yields. It's crucial, though, to balance the appeal of these yields with an understanding of how CLOs work. Here's what makes them appealing:

High Yield Potential: CLOs often offer higher yields compared to other fixed-income investments. This is especially appealing in a low-interest-rate environment, where investors are on the lookout for stronger returns.

Risk Distribution: By pooling together a variety of loans, CLOs distribute risk. This means the impact of any single loan default is minimized, offering a level of protection against individual borrower failures.

Access to Diverse Loans: CLOs give investors exposure to a wide range of corporate loans, which might be difficult to access individually. This opens up more opportunities in different sectors and industries.

Conclusion

In essence, while the high yields of CLOs are undoubtedly attractive, they come with their own set of complexities and risks. Understanding these is key for anyone considering CLO-focused Closed-End Funds. The lesson from history, especially from events like the 2008 financial crisis, is clear: high returns often come with high risks. Investors should weigh these risks against the potential benefits, considering their individual investment goals and risk tolerance. Like any sophisticated investment strategy, a deep dive into the specifics of CLOs, and the CEFs that invest in them, is crucial before making an investment decision.